Yield Spreads and the Corporate Bond Rollover Channel

Florian Nagler

Review of Finance, Volume 24, Issue 2, March 2020, Pages 345–379, https://doi.org/10.1093/rof/rfz005

When firms have exposure to rollover maturing bonds their rollover costs depend on the liquidity in the market. That is, a lower level of liquidity leads to higher yields and thus larger rollover costs. In this paper, I empirically investigate the asset pricing implications of the bond rollover channel.

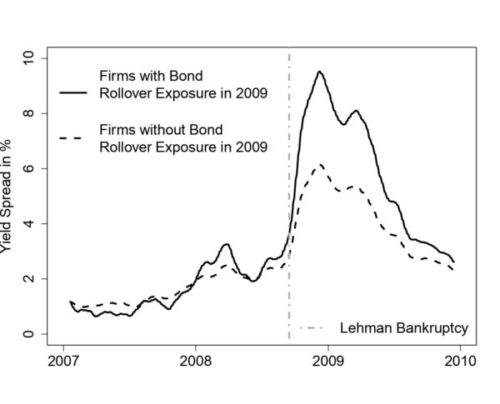

Specifically, I utilize the Lehman bankruptcy in September 2008 as a shock to bond market liquidity, and exploit the fact that firms vary in the size of their rollover exposure around the event date. That is, I classify a firm as treated if its rollover exposure is at least 10% of its total bond financing in 2009. I then compare the yield spread reactions of treated firms around the time of the Lehman bankruptcy to other firms that exhibit no such rollover exposure, while controlling for several bond- and firm-specific characteristics. Figure 1 presents the yield spread dynamics of the two groups of firms around the time of the Lehman bankruptcy. As implied by the theory of the rollover channel, the yield spreads of treated firms react stronger to the liquidity shock compared to the yield spreads of the non- treated firms. Overall, the average treatment effect is 158 basis points.

Further, I find that there is heterogeneity in the treatment effect; for example, the treatment effect increases in the credit risk of the firm as well as in the size of the rollover exposure. I also find that neglecting the heterogeneity in firms’ rollover exposure policies leads to biased estimates of the asset pricing impact of the rollover channel. That is, I find that without controlling for firms’ rollover policies the treatment effect would be overestimated by as much as 117 basis points around the Lehman bankruptcy.

In the final part of the paper, I examine the direct and indirect pricing impact via the rollover channel of changes in illiquidity on yield spread changes at the individual bond level. Thus, the identification of the rollover channel comes from the individual bond level while absorbing unobservable macroeconomic and firm-specific variation. I find that most of the yield spread sensitivity to changes in illiquidity is due to the indirect impact caused by the rollover channel – more than two-thirds of the overall pricing impact of illiquidity is due to the bond rollover channel.

Figure 1